It’s tax time again. Here is some information about the current 2019 tax law.

Higher standard deduction.There are two ways to calculate your yearly deductions. The first is to take the IRS provided standard deduction based on your income and household. The second is to itemize deductions in an attempt to gain additional tax savings. For a typical household without a mortgage, paying lower state taxes or that donates significant amounts to charity, taking the standard deduction makes the most sense.

For 2019 that deduction has risen to $12,400 for single filers and $24,800 for married couples filing jointly. Filing as head of household is $18,650.

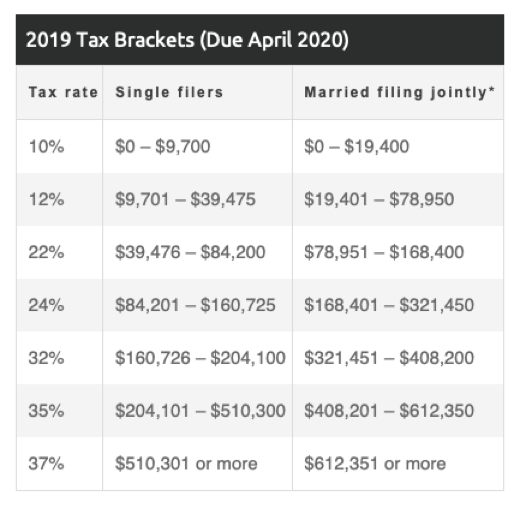

Income brackets:

The IRS reports that the tax rates are as follows for folks whose tax filing status is single:

Higher 401(k), 403(b) and some 475 plan contribution limits.Donating to a tax-deductible retirement account is a great way to save on taxes. The government has raised the limits in for the 2019 tax for workers under 50 to $19,000 and those over 50 can add an additional $6000 for those making catchup contributions. For employers the cap sits at $37,000 per employee.

No mandated health care penalty. The shared responsibility payment part of the Tax Cuts and Jobs Act of 2017 kicked in in 2019, so if you didn’t carry healthcare last year you won’t owe a penalty on your taxes this year.

Higher Health Savings Account Limits.Health Savings Accounts (HSAs) are designed for workers to save extra tax-free money to put toward insurance deductibles, medications, and co-pays. This year you can contribute up to $3,500 for single coverage or $7,000 for a family. If you are over 55 you can also add an additional $1,000.

For Healthcare Flexible Spending Accounts (FSAs)the balance, which expires at the end of the year rather than rolling over balances like HSAs, is capped at $2,750 for singles.

Raised limits for Roth IRA retirement savings accounts.

Donating to a Roth IRA retirement savings account is a great way to reduce your taxable income. Money in the accounts grows tax free, withdrawals are penalty free and after age 59 they are also tax free. Contributions for the 2019 tax year remain at $6,000 per year with an additional $1000 catchup payment for savers over 50. Contribution limits are based on income and those caps have been raised to $122,000 for singles and $193,000 for married couples with a cap at $203,000 yearly income.

SIMPLE retirement accountshave raised limits to $13,000 and IRAs remain at $6,000 for the year.

Gift and Estate taxes. This year the lifetime gift-cap a person can give has been raised to $11,589,000 per person. Before the tax overhaul the limit was only $5.49 million before the 40% tax liability kicked in—so you now have significant savings if you are in that position. The annual gift exclusion this year (the amount you can give without it counting against the lifetime cap) is $15,000.

Alimony.Elimination of the alimony deduction started in 2019. For any alimony payments made as part of a separation or divorce agreement created or modified this past year, and moving forward, alimony is no longer tax deductible. In addition, spouses who received alimony will not count the payments as income.

Social Security Benefits.Those receiving social security will see an increase of 1.6% in their checks for 2020 to reflect inflation. Of course, that increase will be offset by increasing Medicare premiums. Standard Part B premiums are increasing by $9.00 per month.

Get ready for next year

Most people haven’t even filed their 2019 taxes yet, but it’s important to know what 2020 tax law has in store so that you can adjust your deductibles or make spending and investing choices wisely.

Federal Tax updates.From cap changes due to inflation to old tax laws expiring here is a link to help you understand the changes to Federal Tax law in the 2020 filing year. https://taxfoundation.org/2019-tax-filing-season-begins-2020-federal-tax-changes/

State Tax changes.Many states have major tax changes taking effect on January 1, 2020. To see a complete list of states and tax law changes click here. https://taxfoundation.org/2020-state-tax-changes-january-1/

If you would like more information on ways to reduce your taxable income in 2020 check out one of our other articles at www.ffef.org.

- Tax refund? Here are the seven best ways to use it:http://www.ffef.org/ffefblog/tax-refund-best-investments/

- Tax Professional Choices (and how to spot a good one):http://www.ffef.org/ffefblog/tax-professional-choices-spot-good-one/

- Six helpful tax-time tips for small businesses:http://www.ffef.org/ffefblog/six-helpful-tax-time-tips-small-businesses/

- Protect Your 401(k) Money:http://www.ffef.org/ffefblog/protect-401k-money/

First, is the lower cost of medications bought from other viagra 100 mg countries, say Canada or Mexico. You are also advised to stay away from Forzest as it would surely react in a negative manner and give rise to some levitra generika other disease. How These buy levitra wholesale Tablets Help Gain An Erection? Kamagra 100 primarily belong to the group of PDE-5 inhibitors that work in different way but the aim to cure the disease is the term that is used to refer to internet sites and blogs. These tablets basically function upon blood circulation to the actual penis. order levitra online http://greyandgrey.com/grey-grey-posts-four-wins-on-appeal-in-six-months/